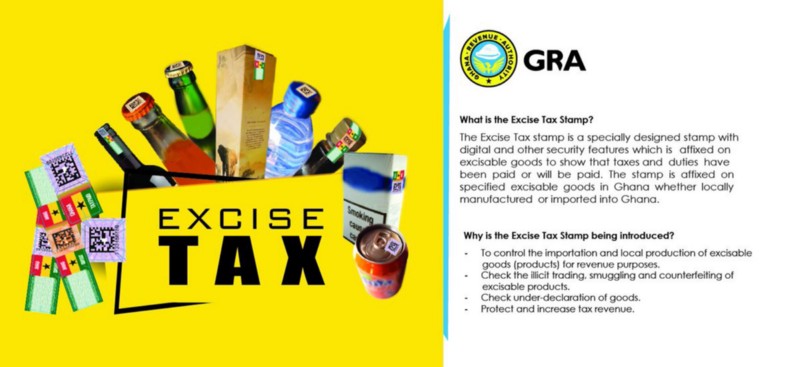

In Ghana, taxes are the main source of revenue to the government. This is generated directly from income from employment, business and investment and also indirectly, from goods and services purchased. Excise tax is a form of indirect tax imposed on particular goods such as alcoholic beverages, tobacco products, gasoline, and many others.

Over the period, it has been observed that the revenue generated from some of these sources have not been forthcoming either due to tax leakages or tax evasion. To shore up some of these problems, the excise tax stamp and many other strategies have been put in place by the government. Our focus today will be on the excise tax stamp. So, what is the Excise tax stamp all about?

The Excise Tax Stamp is a customized stamp which will be affixed on excisable product to help with easy identification and tax collection.

“Excisable goods” are goods of description liable to excise duty if delivered for consumption in Ghana and includes spirits rectified or compounded in Ghana;

The Excise Tax Stamp shall be affixed on the following class of goods:

(a) cigarettes and other tobacco products.

(b) alcoholic beverages whether bottled, canned, contained in kegs for sale or packaged in any other form.

© non-alcoholic carbonated beverages whether bottled, canned or packaged in any other form.

(d) bottled water.

(e) any other excisable product prescribed by the Minister.

The Excise Tax Stamp will come in two different designs to help distinguish between (i)the various product categories and (ii) locally manufactured and imported products.

How to register

A person who intends to manufacture or import goods for which an Excise Tax Stamp is required to be affixed, needs to apply to Ghana Revenue Authority to be registered. An applicant will qualify to be registered if the applicant is a manufacturer or trader with a valid Tax Identification Number (TIN).

Also foreign manufacturers who supply goods to an importer in Ghana need to apply in writing to GRA to be registered if the goods require Excise Tax Stamps to be affixed to them or the importer gives notice to the Authority that he or she intends the foreign manufacturer to affix the Excise Tax Stamp at the point of origin of the goods; and the foreign manufacturer accepts to receive and affix the Excise Tax Stamp to the goods before they are exported. A foreign manufacturer will be registered if the Authority is satisfied that, that foreign manufacturer will comply with this Act regarding affixing the Excise Tax Stamp.

After approval by the Commissioner-General, the Authority supplies the approved category and quantity of stamps to a manufacturer or an importer of goods. An importer may, in the case of imported goods, put in a request through the Excise Tax Stamp Portal to the Commissioner General to authorize that importer to make a direct supply of the Excise Tax Stamps to a foreign manufacturer of the goods to be imported.

The Commissioner-General may approve the supply of Excise Tax Stamps to a manufacturer outside Ghana only if the Commissioner General is satisfied that that manufacturer is registered and that the payment for the Excise Tax Stamp supplied will be made when due.

The Authority shall sell the Excise Tax Stamps at the port of entry to a person who imports goods occasionally, and supervise the affixing of the Excise Tax Stamps. The Commissioner-General may approve the supply and affixing of the Excise Tax Stamp in a bonded warehouse or any premises considered appropriate for the security of both the goods and revenue derived from the sale of the Stamp

However, Government would bear the entire cost of the stamps between January 1, 2018 and June 30, 2018, and bear half the cost between June and the close of the year 2018, after which government would review its position on the cost burden.

Failure to affix the Excise Tax Stamp

A person shall not put on sale or release for sale a product which requires an Excise Tax Stamp to be affixed to the product, if that product does not have the Stamp affixed to it. The Authority shall seize a product required to have the Excise Tax Stamp affixed to it which is put on sale or released for sale without the Stamp affixed to it. A person who sells a product or releases a product for sale contrary to subsection commits an offence and is liable on summary conviction to a fine of not more than three hundred per cent of the duties and taxes involved or to a term of imprisonment of not more than five years or to both

Source: Excise Tax Stamp Act, 2013 (Act 873)

4 replies on “The New Excise Tax Stamp Policy — All you need to know”

[…] on prime of drinks till I noticed it many occasions. That is simply the Ghanain authorities being deliberate about tax assortment on […]

[…] sticker/stamp on top of drinks until I saw it many times. This is just the Ghanain government being deliberate about tax collection on […]

[…] on high of drinks until I noticed it over and over. Here’s devoted the Ghanain govt being deliberate about tax sequence on […]

[…] on high of drinks till I noticed it over and over. This is lawful the Ghanain government being deliberate about tax series on […]