A profit-and-loss statement is a crucial financial document for any business. Understanding its various components is important, no matter what type of accounting software you use.

In this article, you’ll find an overview of the essentials of a profit and loss statement, its significance and types, along with step-by-step instructions for preparing one, complete with examples.

What is a profit-and-loss statement?

A profit and loss statement, also known as an income statement, revenue statement, or P&L, is a financial report that details a company’s revenues, costs, and expenses over a specific period—typically a month, quarter or fiscal year.

It offers business owners and potential investors a clear snapshot of the company’s financial performance, showing how much money is being made and where losses may be occurring.

While you can create a P&L statement for any time frame, they are most commonly prepared on a monthly, quarterly, or yearly basis.

Importance of a Profit and Loss Statement

- A P&L statement helps you understand whether your business is profitable by showing the relationship between revenue and expenses.

- It helps business owners and managers make data-driven decisions about cost-cutting, pricing strategies, and investment opportunities.

- A P&L statement is crucial for determining taxable income, making it easier to file accurate tax returns.

Types of profit and loss statements

- Cash Accounting Method

This method records income and expenses only when cash is actually received or paid.

For example, if you send an invoice in December but don’t receive payment until January, the income is recorded in January under the cash method.

This approach is simpler and is often used by smaller businesses because it gives a clear view of cash flow.

- Accrual Accounting Method

In contrast, the accrual method records income when it is earned (regardless of when the cash is received) and expenses when they are incurred (regardless of when they are paid).

For example, if you send an invoice in December, it is recorded as income in December, even if you don’t receive payment until January.

This method provides a more accurate picture of a business’s financial health and is generally required by larger businesses and for compliance with accounting standards.

Steps in Creating a P&L Statement

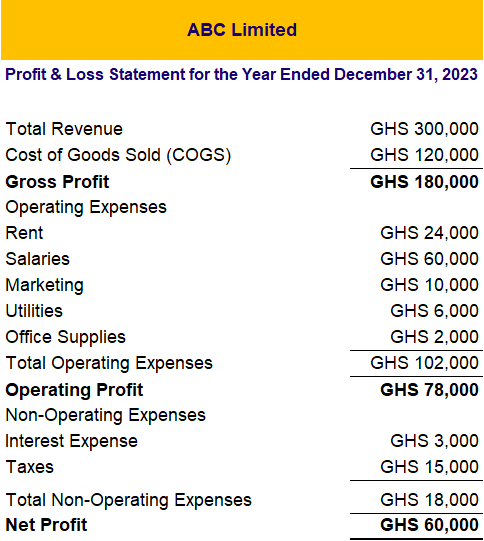

Step 1: Collect Revenue Data

The initial step in preparing a P&L statement is to collect all sources of revenue. Revenue represents the total income earned from selling goods or services.

To ensure a detailed and accurate P&L statement, it’s essential to maintain a comprehensive and ongoing record of all payments received from sales, along with any other incoming revenue. Thus, an accurate daily sales record must be kept.

Step 2: List the Cost of Goods Sold (COGS)

COGS represents the direct costs involved in producing the goods or services your company offers. This typically includes variable expenses like cost of inventory sold, purchase of raw materials and other direct labour costs, rather than fixed costs such as leases.

In some businesses, income tax may be included in the cost of sales. However, for sole proprietorships, partnerships, and Ltds, , business owners generally pay these taxes as part of their income tax filings.

Example: “For a bakery, the cost of flour, sugar, eggs, and labor used to bake the goods would be included under COGS.

Step 3: Calculate Gross Profit

To calculate gross profit, simply subtract the cost of sales from total revenue for the month, quarter, or year.

This figure shows the profit a company makes after deducting the costs directly tied to producing its products or services.

Formula:

Gross profit = revenue – COGS

Example: “If your total revenue is $100,000 and your COGS is $40,000, your gross profit would be $60,000.

Step 4: Deduct Operating Expenses

Operating expenses are the costs necessary to keep the business running but are not directly linked to producing goods or services.

These expenses include rent, utilities, salaries (apart from those accounted for in COGS), marketing expenses, and office supplies.

Step 5: Calculate Operating Profit

To ascertain your operating income, subtract your overhead from your gross profit. This number indicates the profitability of your core business operations, excluding non-operating income and expenses.

Formula:

Operating Profit = Gross Profit – Operating Expenses

Step 6: Account for Non-Operating Income and Expenses

Next, factor in any non-operating income and expenses. These can include items such as interest income or expenses, taxes, and any one-time gains or losses from asset sales.

Expenses might involve loan interest, finance charges, or, in the case of an Ltd, tax payments made from pre-tax income.

Step 7: Calculate Net Profit

The final step is calculating the net profit, which is the bottom line of the P&L statement. Net profit shows the total earnings after all expenses, including COGS, operating expenses, and non-operating items, have been deducted from revenue.

Formula:

Net Profit = Operating Profit – Non-Operating Expenses + Non-Operating Income

Analyzing the P&L Statement

Conclude by discussing how to interpret the P&L statement. A positive net profit reflects profitability, whereas a negative net profit indicates a loss. Urge readers to leverage this statement to make informed business decisions, like reducing unnecessary costs or investing in profitable areas.

Bonus Tips for Accuracy

To ensure accuracy, it is important to regularly update financial records, use Built’s accounting software, and consult with a financial professional. These practices will help maintain precise and reliable financial statements

Balance Sheet vs. Profit and Loss Account

Understanding a company’s financial performance requires a close look at both the balance sheet and the profit and loss statement, as each provides distinct insights.

The balance sheet offers a snapshot of the company’s financial position at a specific moment in time, detailing what the company owns, what it owes, and the equity that remains. In contrast, the profit and loss statement summarizes the company’s revenues, expenses, and profits or losses over a set period.

While the balance sheet emphasizes financial stability and liquidity, the profit and loss statement focuses on profitability and overall financial performance. Both statements are crucial, and stakeholders rely on them to make well-informed decisions.

Profit and Loss Statement

A common inquiry among new startup founders regarding the three primary financial statements is, “Are the profit and loss statement and the income statement the same?” The good news is that the answer is straightforward: Yes, they are indeed the same.

Gaining the ability to create and interpret a P&L statement enables you to make well-informed decisions, draw in investors, and keep your business headed in the right direction.

Whether you’re just starting out or running an established company, mastering the P&L statement is essential for long-term success.

Conclusion

A profit and loss statement is an essential resource for every business owner, offering a clear view of the company’s financial condition and profitability.

Learning how to prepare and interpret a P&L statement equips you to make smart decisions, appeal to investors, and keep your business on the right track.

The sentence is almost correct but could be clearer with a slight adjustment. Here’s a refined version:

Whether you’re launching a new venture or managing an established company, mastering the P&L statement is crucial for sustained success when you use Built.

No Comments