Understanding bank reconciliation statements is key to keeping your financial records accurate.

This article will show you the basics of bank reconciliation, including how to compare your bank statement with your own records, spot any differences, and make the needed changes.

What is a bank reconciliation statement?

Bank reconciliation is the process of comparing the balance in your records with the balance on your bank statement. The goal is to identify and correct any discrepancies between the two balances. These discrepancies might arise from outstanding checks, bank fees, direct deposits, errors, and more.

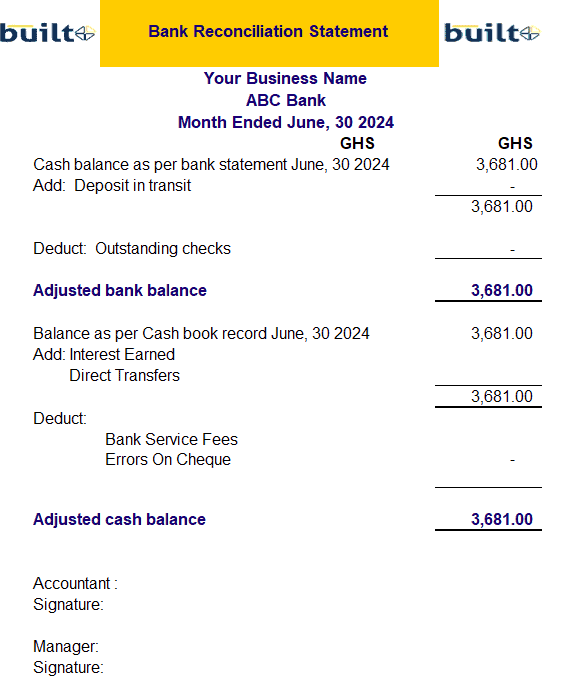

The bank reconciliation statement is the document that summarizes this process. It shows any discrepancies between the two balances and explains why they occurred. The statement also includes endorsements from the accountant and management.

Why is bank reconciliation important?

Bank reconciliation is a fundamental aspect of financial management for both individuals and businesses and here are several key reasons why bank reconciliation is important:

1. Ensures Accuracy in Financial Records

One of the primary reasons for performing bank reconciliations is to ensure that your financial records are accurate. Regular reconciliation helps keep your financial records accurate. It identifies and corrects discrepancies, so your records reflect your true financial position.

2. Detect Potential Fraudulent Activity

A detailed reconciliation can reveal fraudulent activities. For instance, if a company has issued a check for GHS 550 to a mechanical repair company but notices a debit of GHS 650 on its bank statement for the same transaction, it raises an immediate red flag.

3. Improves Cash Flow Management

Regular reconciliation helps businesses track the inflow and outflow of money in their accounts. Understanding your actual bank balance allows you to manage cash flow more efficiently, ensuring you have enough funds to meet obligations, avoid overdrafts, and plan for future expenses.

4. Ensures Compliance with Best Practice

Accurate financial records are essential for regulatory compliance. Regular reconciliation helps ensure your records are correct and complete, avoiding legal issues.

How to do a Bank Reconciliation

- Get your bank statement and internal financial records for the period you want to reconcile. For instance, if you intend to reconcile June’s statement, get a copy of the June bank records (statements) and the accounting ledger of the bank account for June.

- Ensure the opening balance on your bank statement matches the opening balance in your records. For example, does the opening balance on June’s bank account match the opening balance of the June accounting ledger? If you find a discrepancy, investigate it and make the necessary adjustments.

- Check that all deposits on your bank statement match those in your records. Identify and investigate any discrepancies; these may be as a result of cheques that are yet to clear or even cheques that are yet to be presented by your suppliers.

- Compare your bank statement withdrawals with your internal records. Identify discrepancies like outstanding checks or unprocessed deposits, and adjust your records accordingly.

- Add any bank fees, service charges, or interest from the bank statement to your records. Correct any errors found in the statement or your records. After adjusting for outstanding checks and deposits in transit, ensure the adjusted bank balance matches your records.

- Create a formal document listing all adjustments made to reconcile the bank statement with your financial records. This statement should include:

- The starting balance

- Additions (e.g., deposits in transit)

- Subtractions (e.g., outstanding checks, bank fees)

- The adjusted balance

Bank reconciliation statement for SMEs

Tips for Effective Bank Reconciliation

- Perform bank reconciliations regularly, such as monthly, to keep your records up-to-date.

- Maintain detailed records of all transactions to make the reconciliation process easier.

- Address any discrepancies as soon as they are identified to maintain accurate records.

- Use Built to streamline the reconciliation process and reduce errors.

No Comments