Running a business in Ghana is exciting, but let’s face it, payroll can be a beast. Between navigating complex tax regulations, ensuring timely payments, and keeping your employees satisfied, it’s enough to make anyone reach for the Panadol Extra. But fret not, entrepreneurs! This comprehensive guide is your roadmap to smooth payroll sailing in Ghana.

Why Outsource Payroll in Ghana?

Time is money, and payroll takes a hefty chunk. Outsourcing your payroll to a reliable provider frees up your time and resources to focus on what you do best – building your business. Here’s what you gain:

- Accuracy and Compliance: Local experts stay on top of ever-changing tax laws and social security contributions, ensuring you avoid costly penalties.

- Efficiency and Automation: Say goodbye to manual calculations and spreadsheets. Modern payroll systems automate tasks, saving you time and minimizing errors.

- Reduced Costs: Outsourcing can be surprisingly cost-effective, eliminating the need for in-house payroll staff and software.

- Improved Employee Relations: Timely and accurate paychecks boost employee morale and reduce stress, leading to a happier and more productive workforce.

Essential Services of a Ghanaian Payroll Provider:

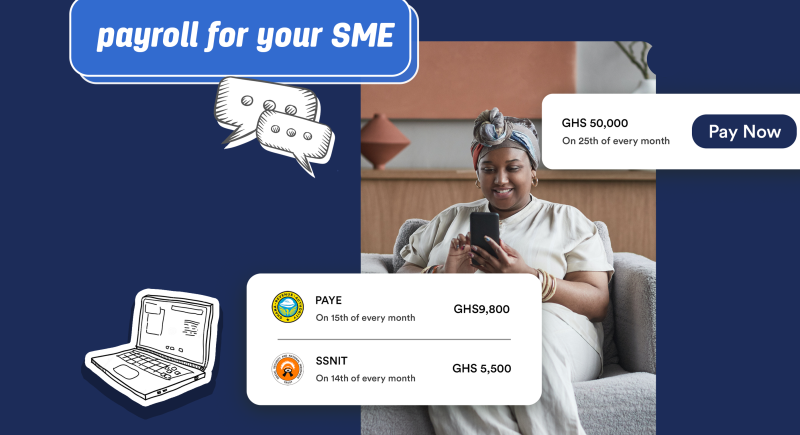

- Salary Calculations: Accurately calculate gross pay, deductions, and net pay for all your employees, including overtime, bonuses, and leave allowances.

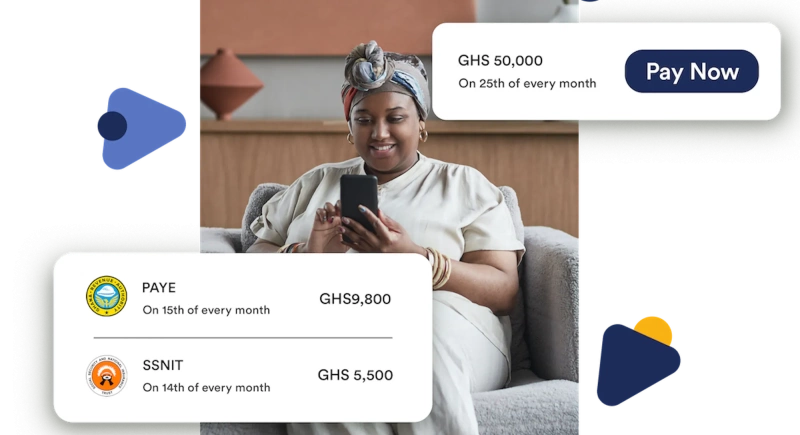

- Tax Deductions and Remittances: Handle the complexities of Pay As You Earn (PAYE) tax, Social Security National Insurance Trust (SNNIT) contributions, and other statutory deductions, ensuring timely remittances to the relevant authorities.

- Multi-Currency Payroll: Manage payroll for employees in different currencies, a must for multinational companies operating in Ghana.

- Reporting and Analytics: Generate comprehensive reports on payroll data, providing valuable insights into your workforce costs and trends.

- Employee Self-Service Portal: Empower employees to access their pay stubs, update their information, and request leave directly through a secure online platform.

Choosing the Right Payroll Provider in Ghana:

Not all payroll providers are created equal. Look for these qualities:

- Local Expertise: Ensure they have a deep understanding of Ghanaian tax laws, regulations, and best practices.

- Robust Technology: A secure and reliable payroll platform is crucial for data integrity and smooth processing.

- Scalability: Choose a provider that can grow with your business, accommodating your future needs.

- Customer Service: Responsive and knowledgeable customer support is essential for resolving any issues quickly.

- Competitive Pricing: Compare fees and services to find a provider that offers good value for your money.We wrote more on this here

Bonus Tips for Smooth Payroll in Ghana:

- Clear Communication: Maintain clear communication with your employees about payroll policies, deductions, and payment schedules.

- Regular Reviews: Schedule regular reviews with your payroll provider to identify and address any potential issues.

- Stay Informed: Keep abreast of changes in tax laws and regulations to ensure compliance.

Investing in a reliable payroll service in Ghana is an investment in your business success. By freeing yourself from the burden of payroll complexities, you can focus on what truly matters – driving growth and achieving your entrepreneurial dreams. Contact [email protected] for a discussion on this or visit www.built.africa/payroll for our payroll solution.